Fun Tips About How To Keep Track Of Personal Finances

Keep track of your credit score and history:.

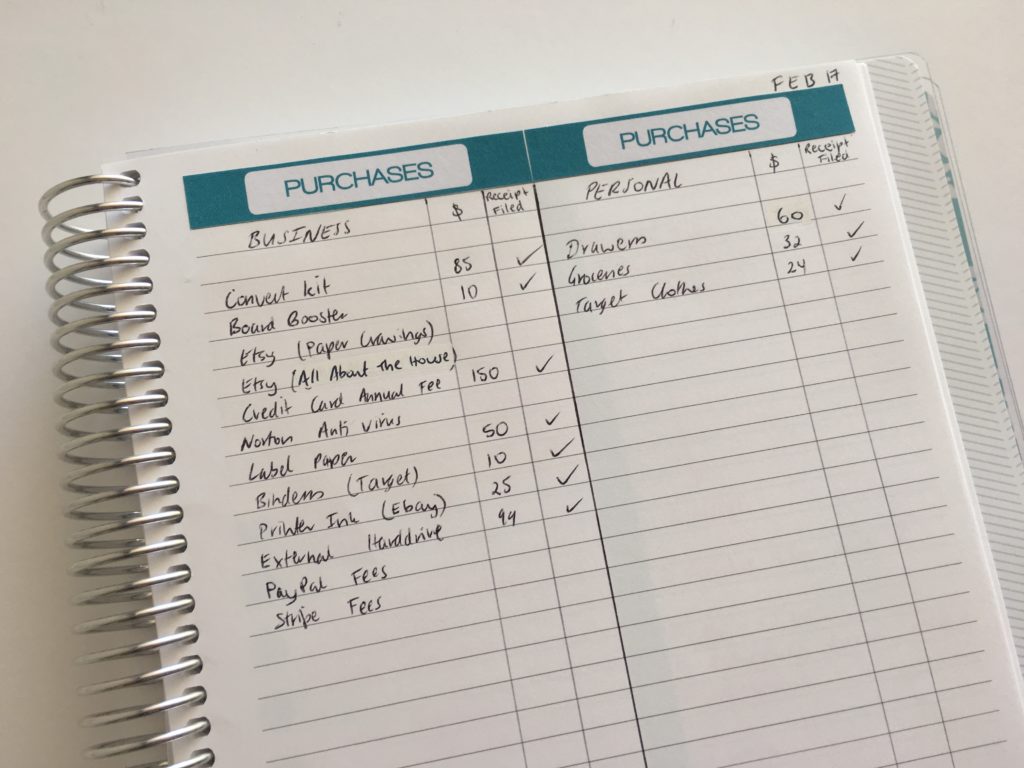

How to keep track of personal finances. Keep track of any personal expenses, business expenditures, and. To manage personal finances well, make sure you understand how your money moves on a daily basis. This means writing down every.

The first thing is to. Use the internet’s power to keep track of your finances by using internet banks. In business, a flexible budget is one that you adjust based on changing costs and revenue.

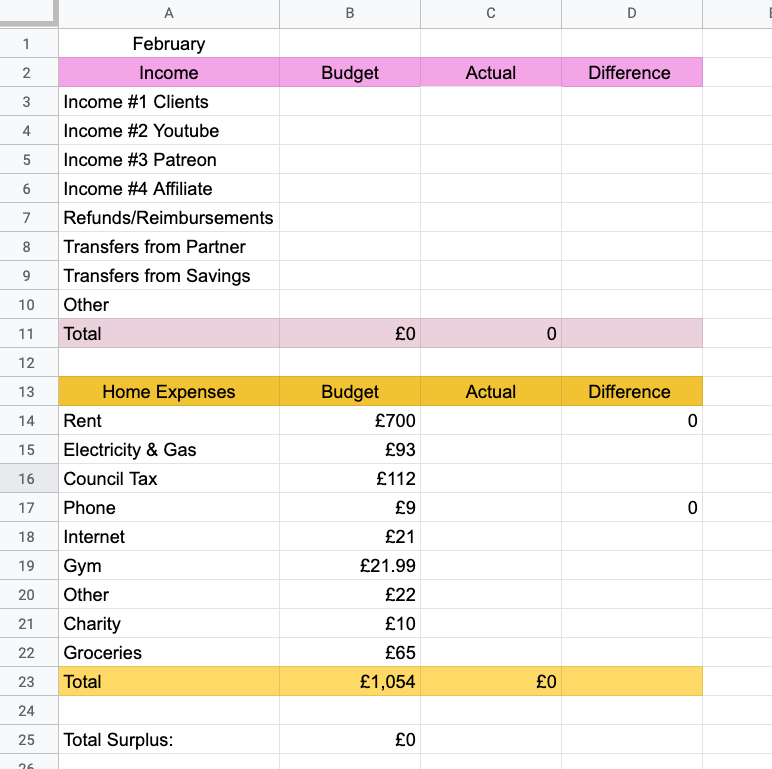

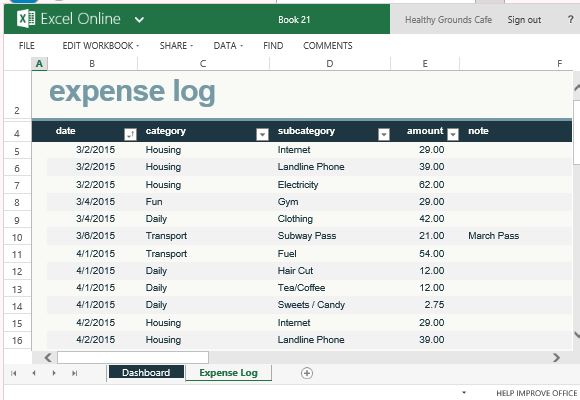

Below are the best free online top 10 personal finance template excel. Set (and stick to) a budget. Keep business and personal finances separate.

Set money aside for taxes. Keep track of your money once your financial accounts 3 are connected, money in excel will automatically import your transaction information from all your accounts into one. The 7 best personal finance apps of 2022.

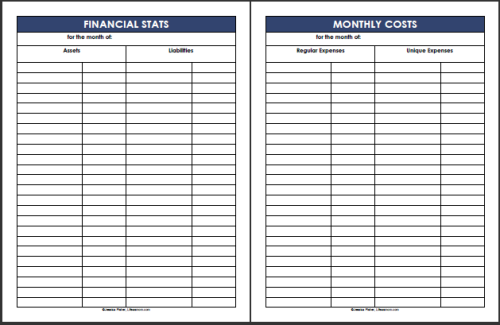

This could be as simple as committing to a. Step 02 — set standing orders from your account for investments this is the part where you automate your save/invest strategy. A forecast of your ending balances at some point in time (cash flow).

6 ways to keep track of your personal finances have honest conversations with yourself you need to be comfortable discussing money with yourself. Use accounting software to track and manage your finances. Next it’s time to compare the money coming in versus the money going out.

![How To Manage Personal Finances And Save Money [11 Powerful Tips] | By Invest Plus | Medium](https://miro.medium.com/max/1218/0*C6SA69AI4QeU4dkT.jpg)