Wonderful Info About How To Find Out What Property Taxes Are

Contact the county treasurer where the property is located for payment options and online services.

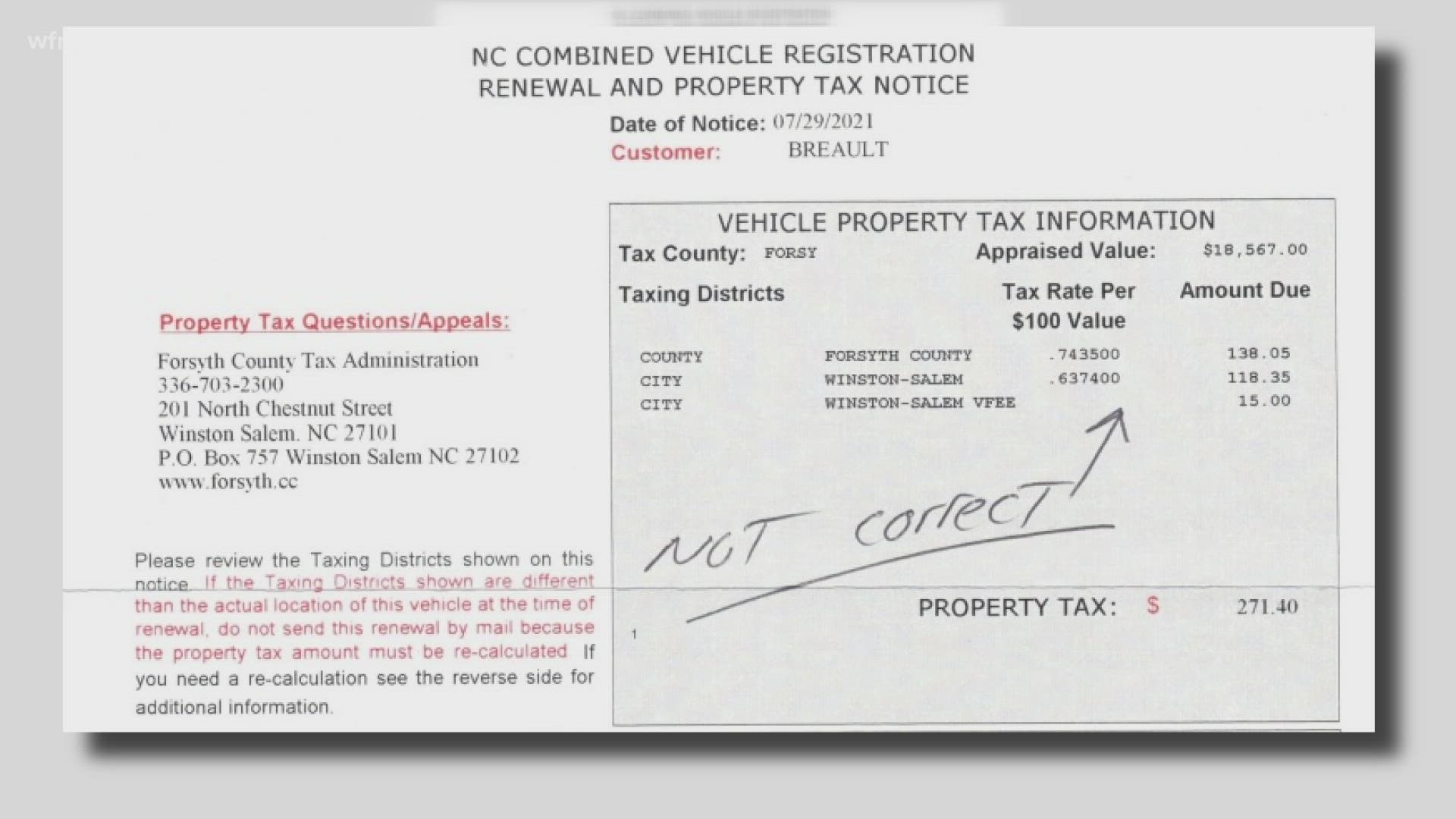

How to find out what property taxes are. Use the map below to find your city or county's. Your area’s property tax levy can be found on your local tax assessor or municipality website, and it’s typically represented as a percentage—like 4%. The notice informs homeowners of the full value and net taxable value of.

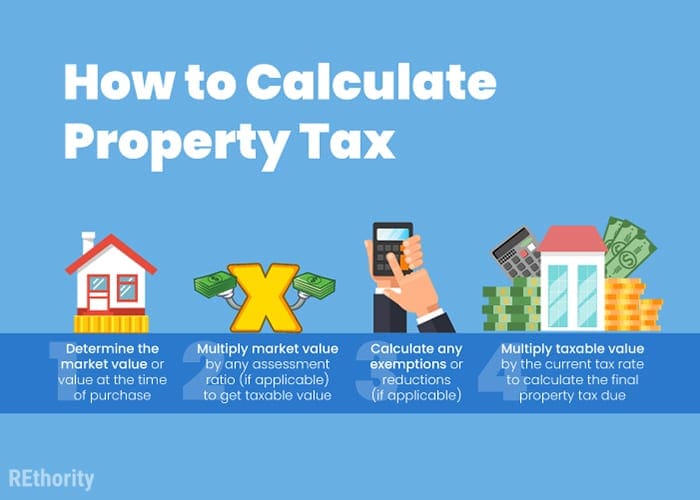

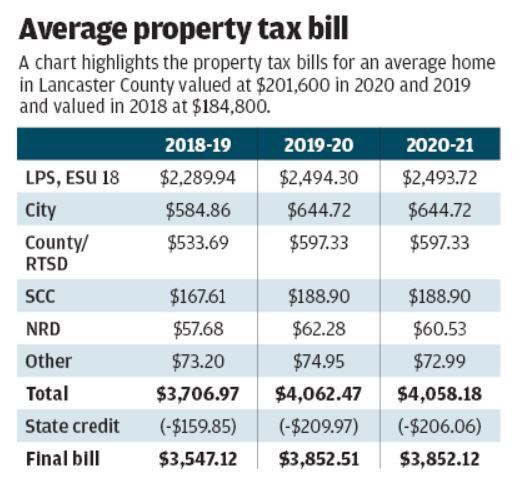

An interim tax bill is mailed out in early february with instalments due the last. To estimate your real estate taxes, you merely multiply your home's assessed value by the levy. Property taxes, federal income taxes, state income taxes, and local property taxes.

Here are some ways to figure it out: To estimate your real estate taxes, you. In person at the linn county public service center, 935 2nd street sw, cedar rapids.

When a bank receives a check made out to a person and a business, i believe the protocol is to deposit to the business. To find out more information on 154 petitions, omitted or incorrectly reported property. If paying by mail or drop box, please include the stub portion of the tax.

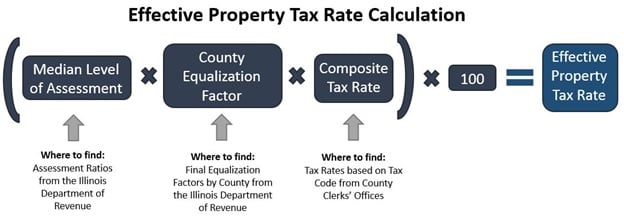

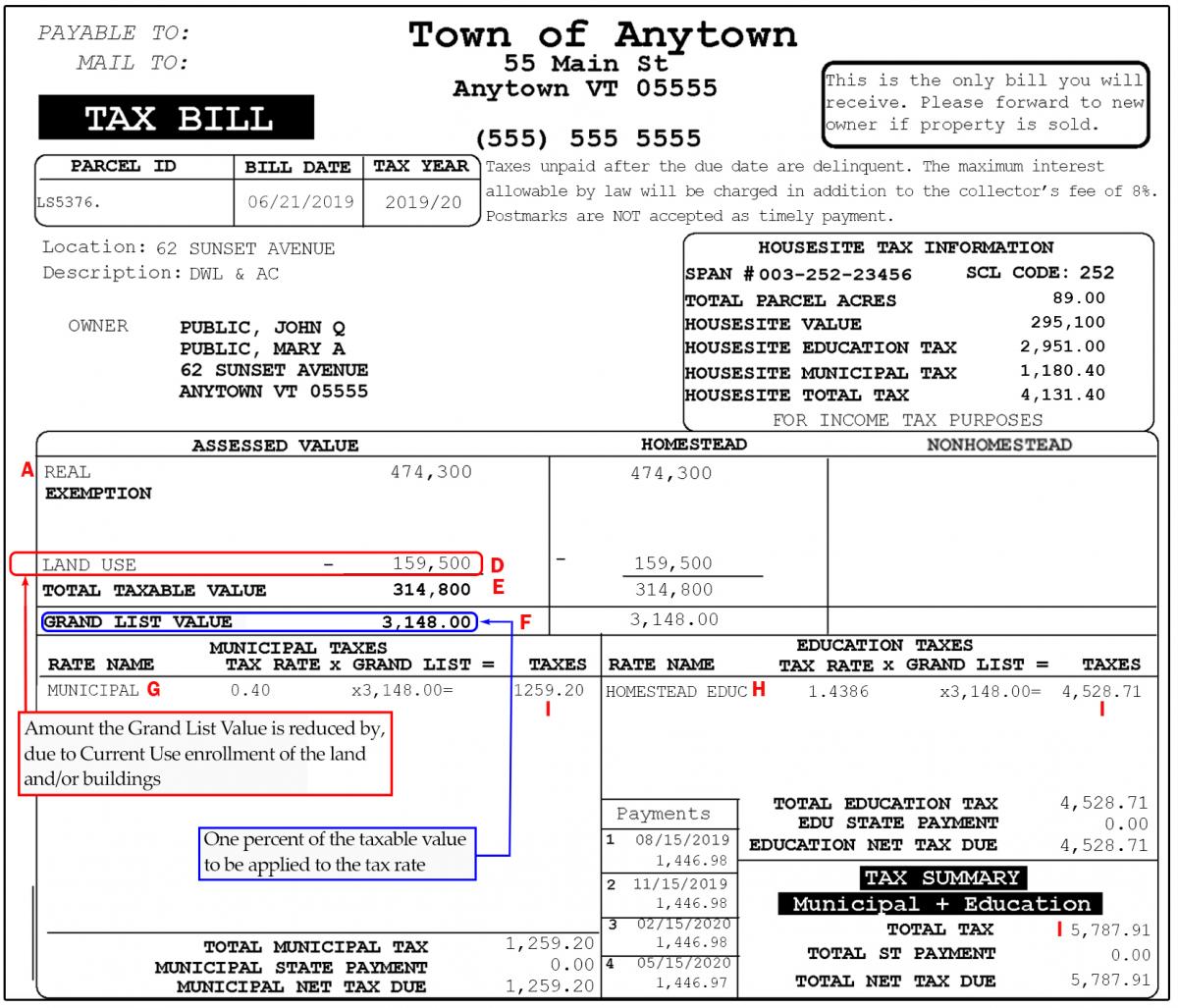

One of the most commonly used formulae is as follows:. Property tax bills tax code section 31.01 requires the assessor to prepare and mail a tax bill to each property owner listed on the tax roll or to that person's agent by oct. A property tax calculator is an incredibly powerful tool.

1) look up county property records by address 2) get owner, taxes, deeds & title. As there are different types of calculation, there are many different formulas for finding out the property tax of a particular property. Property tax & billing information.