Matchless Info About How To Apply For Home Loan Modification

Ad although harp has expired, quicken loans® still has other options you may qualify for.

How to apply for home loan modification. You’ll want to have proof of. Applying for mortgage loan modification. If you feel like it could be beneficial to get a loan modification, contact your lender and request the process.

Refinance your home loan today to get a lower monthly payment or consolidate debt. How you can apply for a loan modification: To apply for these benefits, you must complete an application and meet the general eligibility requirements found online at www.alabamahardesthit.com, including but not.

Fill out the paperwork for the mortgage modification. Up to 25% cash back apply for a modification as soon as possible. Each lender will have its own process.

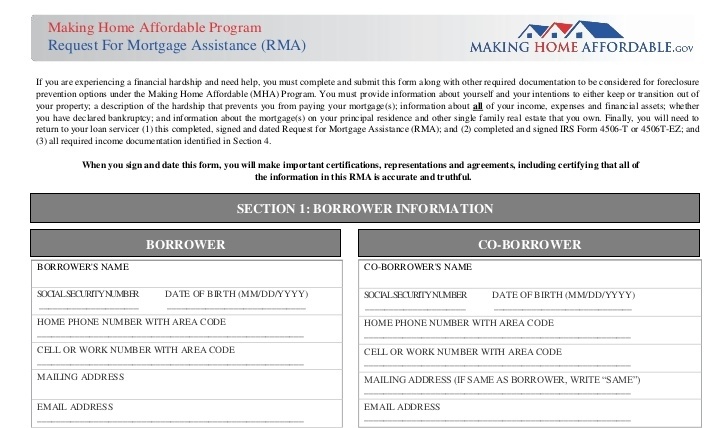

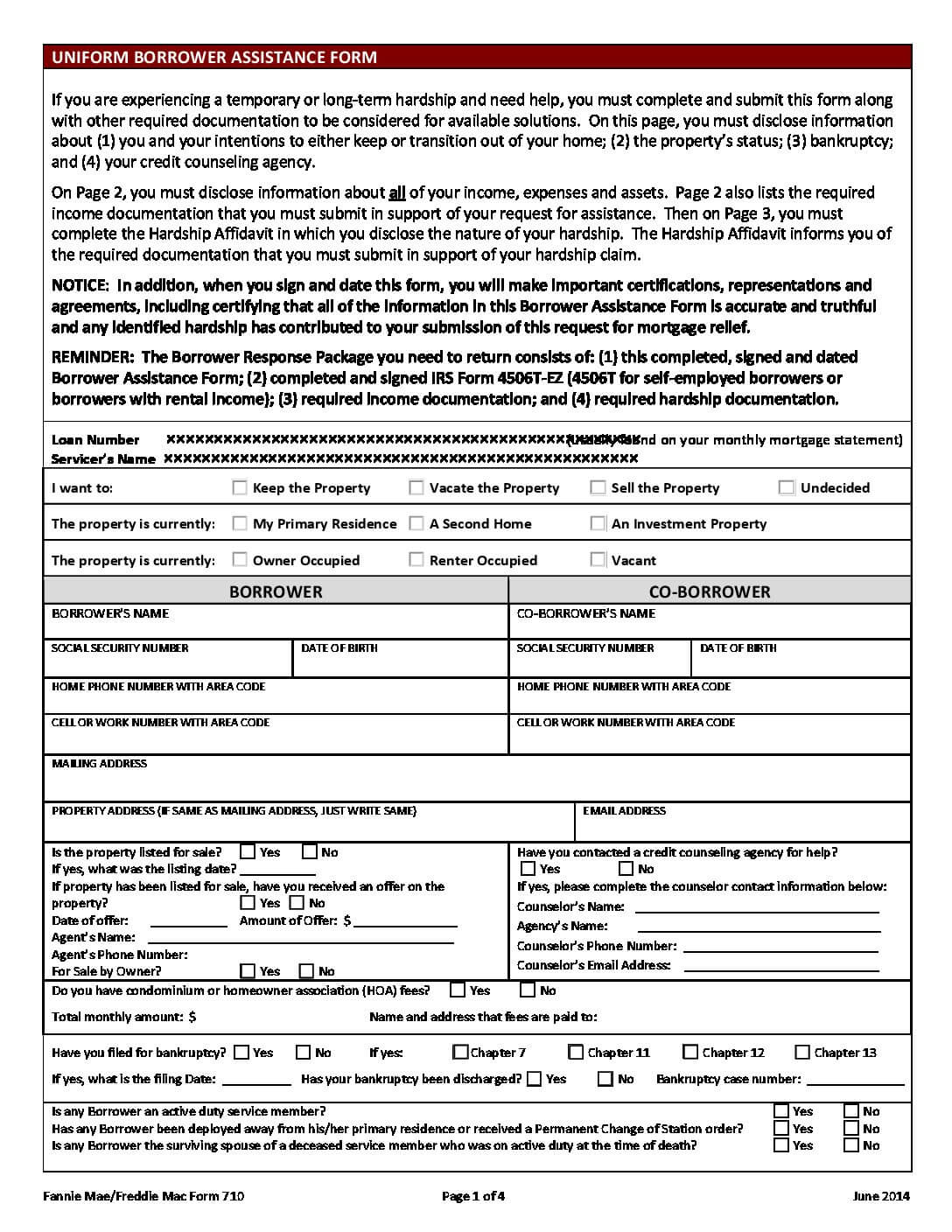

On a making home affordable loan modification, you have to be approved twice. Let's clarify more about mortgage loan modification procedure. Hamp’s goal is to offer homeowners who are at risk of foreclosure reduced monthly mortgage.

To apply for a modification, contact your servicer's loss mitigation department, sometimes called a home retention. Gather your federal tax returns. There are 4 types of assistance for home modifications:

The home modification loan program provides no interest loans to modify the homes of adults and children with disabilities. You’ll need to provide federal tax returns for the past two years as part of your financial picture. If the mortgage company puts the missed payments back into the amounts owed, then interest continues to add up on those amounts.